Condo Insurance in and around Wilmington

Here's why you need condo unitowners insurance

Protect your condo the smart way

Home Is Where Your Condo Is

Being a condo owner isn't always easy. You want to make sure your condo and personal property in it are protected in the event of some unexpected accident or trouble. And you also want to be sure you have liability coverage in case someone becomes injured on your property.

Here's why you need condo unitowners insurance

Protect your condo the smart way

Condo Coverage Options To Fit Your Needs

Despite the possibility of the unpredictable, the future looks bright when you have the wonderful coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your condo and personal property inside, you'll also want to check out possible discounts options for replacement costs, and more! Agent Carrie Zeigler can help you create a policy based on your needs.

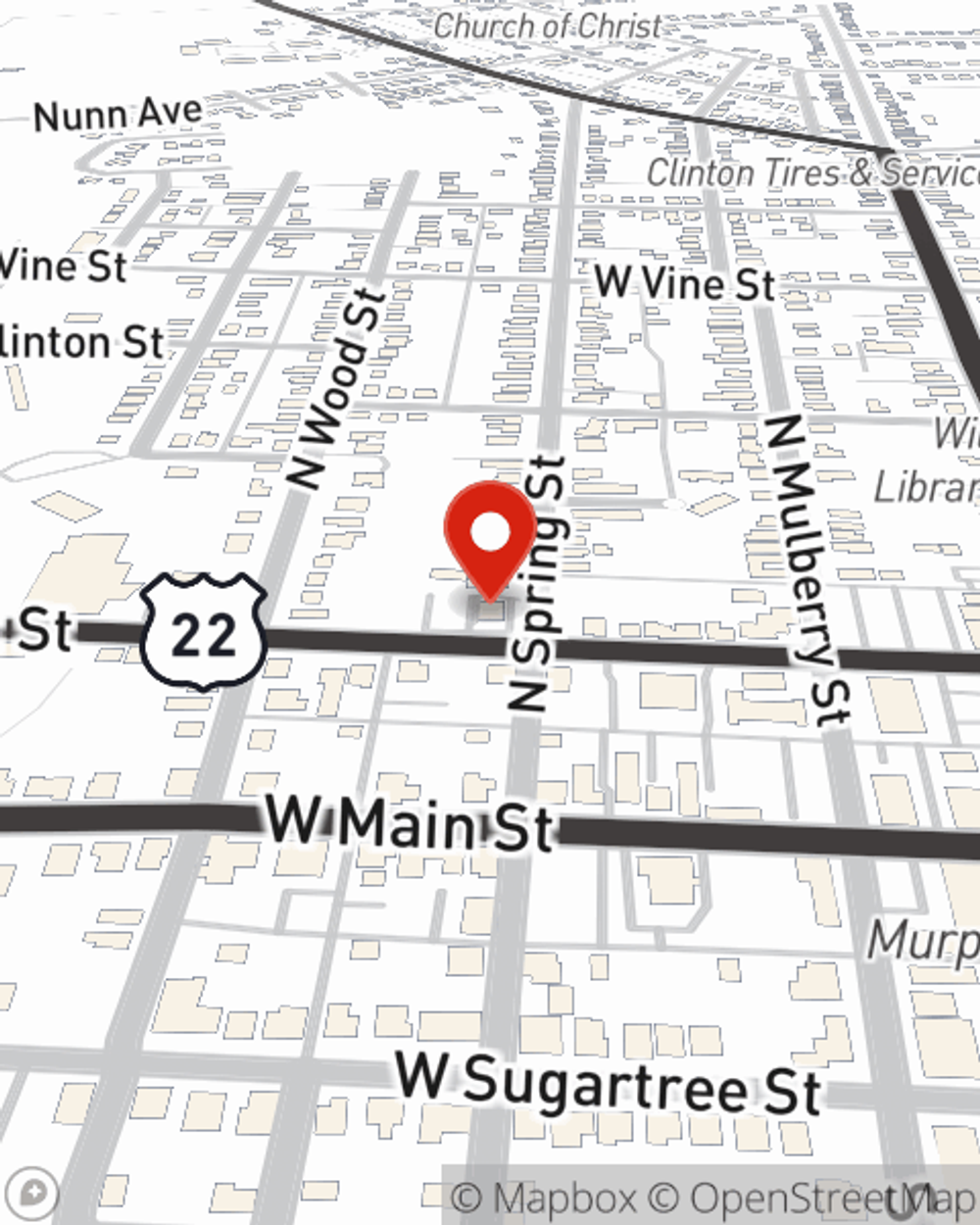

Reach out to State Farm Agent Carrie Zeigler today to check out how one of the well known names for condo unitowners insurance can help protect your condo here in Wilmington, OH.

Have More Questions About Condo Unitowners Insurance?

Call Carrie at (937) 382-4789 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Carrie Zeigler

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.